Empowering Online Education with Klas

Klas, a Nigerian-based online teaching platform, has secured $1 million in pre-seed funding led by Ingressive Capital, with support from Techstars, HoaQ, and various angel investors. Founded in 2022 by Nathan Nwachuku and Lekan Adejumo, Klas offers a comprehensive solution for creating and selling e-books, courses, and live classes, aiming to streamline online education.

Simplifying Online Education

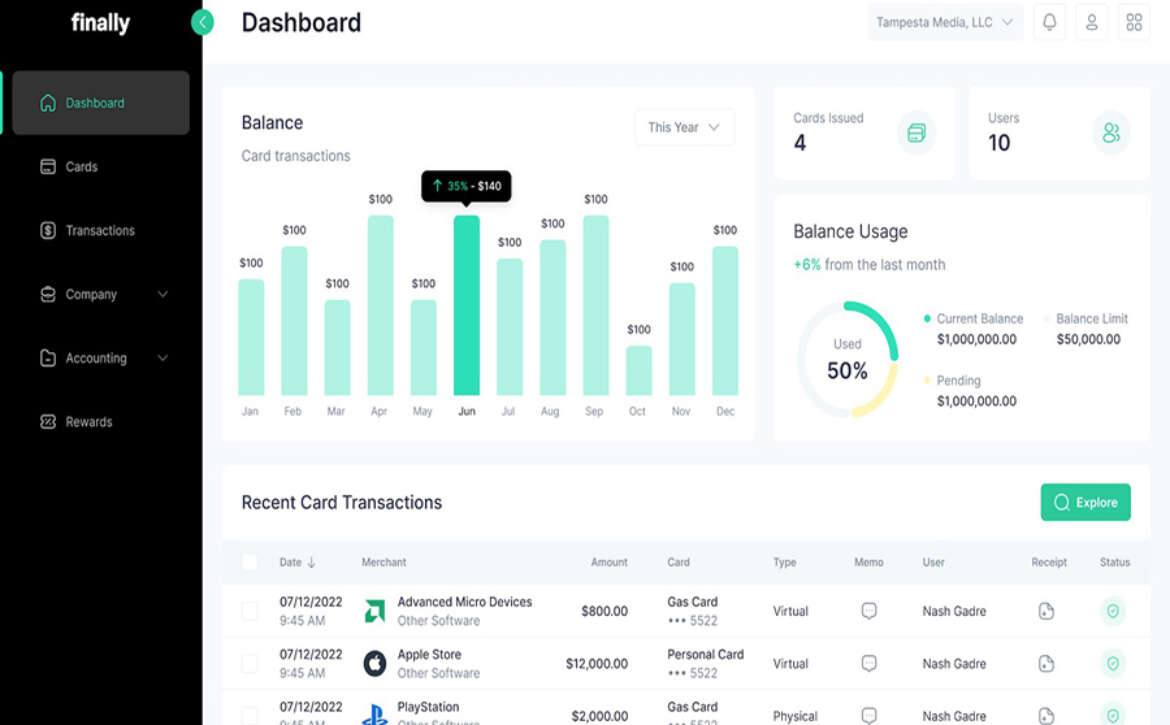

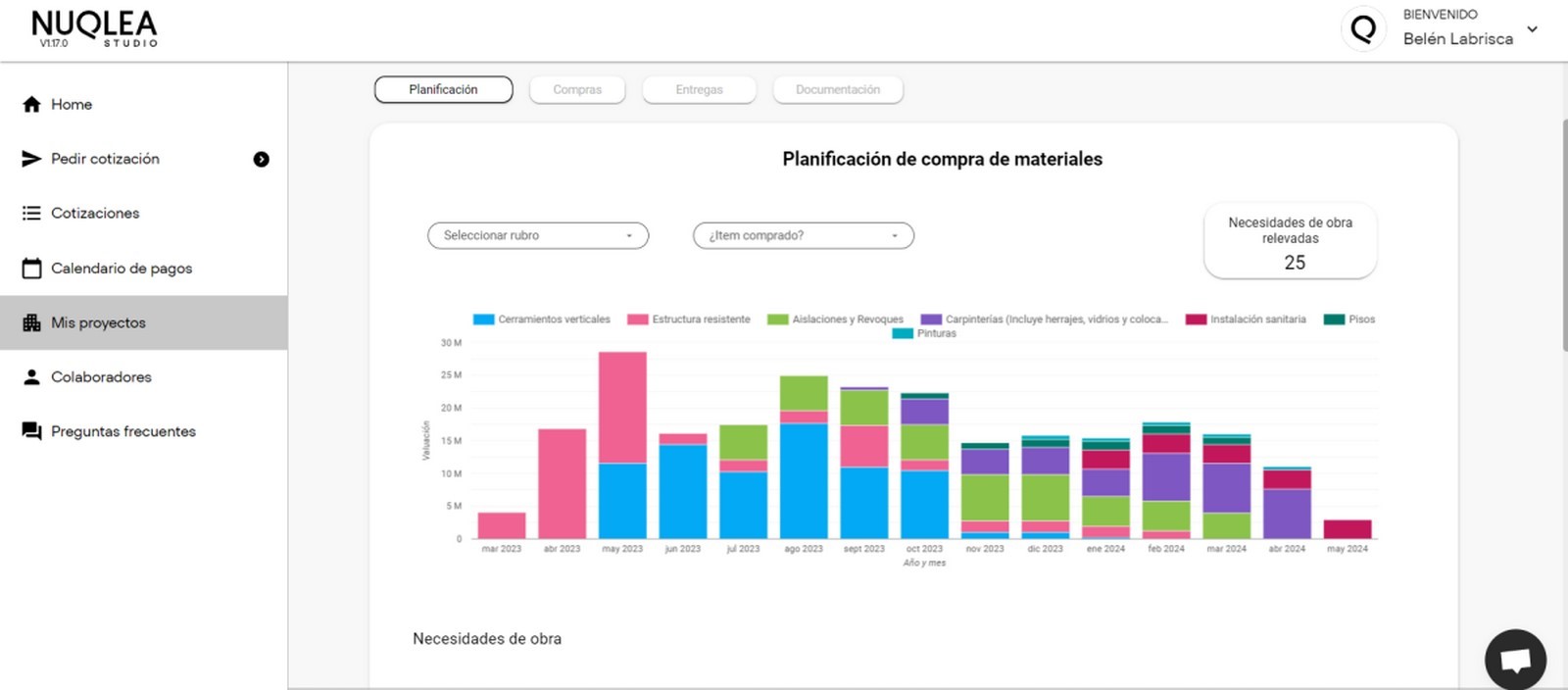

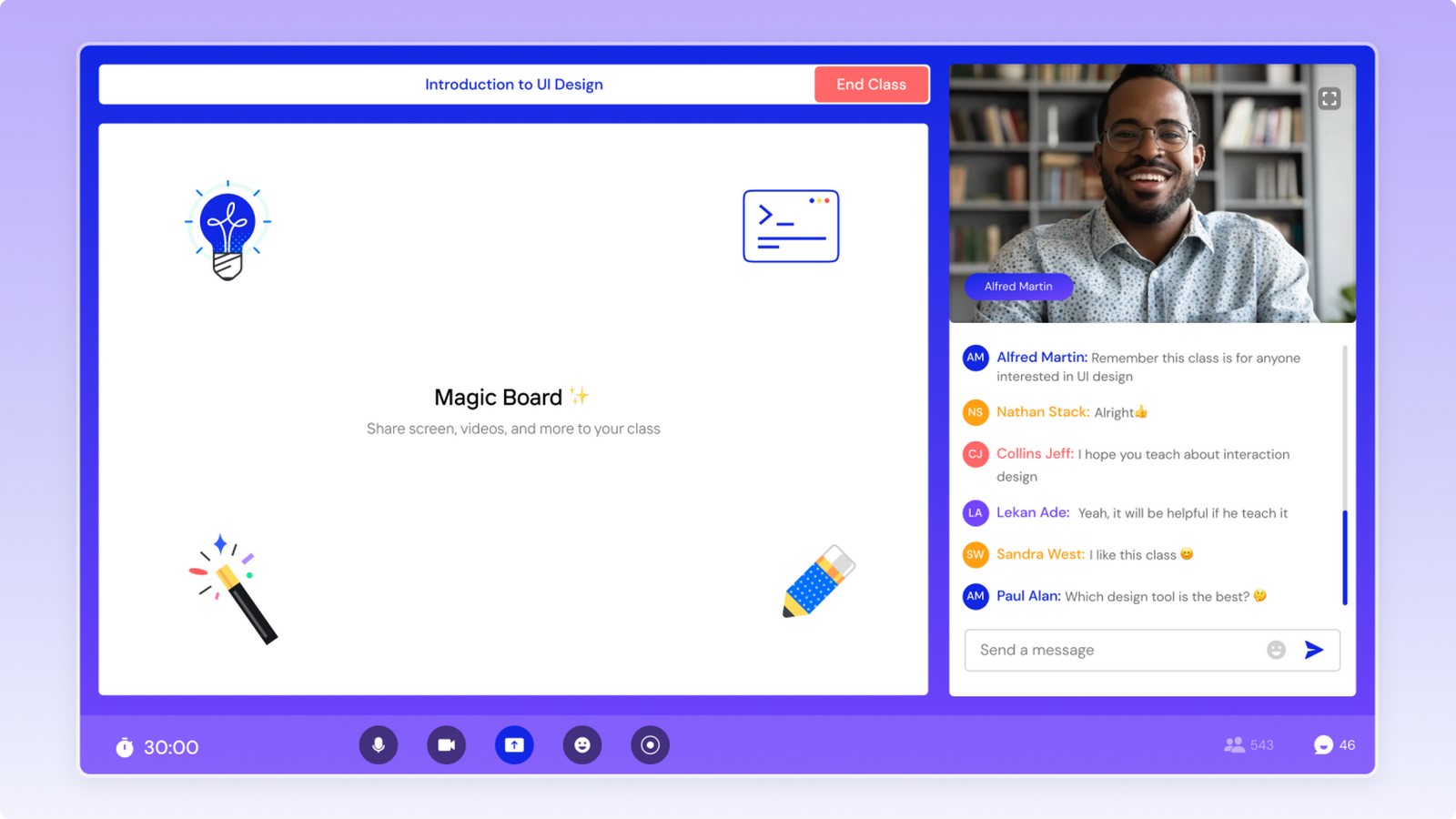

At the heart of Klas is a platform that simplifies the process of setting up and managing online schools. Similar to Shopify’s approach to online stores, Klas empowers users to create their virtual classrooms effortlessly. With essential features like scheduling, payments, community engagement, analytics, and video conferencing, Klas caters to a wide range of subjects, from coding and design to finance, art, and languages.

The Journey to Klas

Nathan Nwachuku, the co-founder and CEO of Klas, embarked on this venture at a young age, driven by a personal experience. Following an accident that resulted in a six-month hiatus from school, Nwachuku recognized the need for accessible online education platforms. His journey led to the inception of Klas, fueled by a passion for physics and a desire to make learning more accessible.

Bridging Gaps in the Market

Klas identified a gap in the market, recognizing that existing platforms could be overwhelming for first-time users. By offering a simple yet powerful toolset, Klas caters to beginners and seasoned educators alike. With a focus on user-friendly experiences and streamlined functionality, Klas aims to address the growing demand for online education worldwide.

Expanding Global Reach

Despite its Nigerian roots, Klas has garnered a global user base, with over 5,000 online schools and 300,000 learners across 30 countries. With a strategic focus on international expansion, particularly in India and North America, Klas aims to diversify its user base and enhance its global presence. By facilitating transactions in local currencies and offering tailored experiences, Klas seeks to meet the diverse needs of learners worldwide.

Future Growth and Innovation

Looking ahead, Klas is poised for exponential growth, with plans to power up to 100,000 online schools by 2027. While the platform currently offers a free plan with a nominal transaction fee, it anticipates introducing enterprise products to cater to large companies seeking to upskill their employees. With continued support from investors like Techstars and a commitment to innovation, Klas is set to shape the future of online education.